School Board Opts For a Bond Proposal to Fund SHS Auditorium and to Keep School Budget Below the Tax Cap

- Category: Schools

- Published: Friday, 10 March 2023 17:57

- Deborah Skolnik

During a Board of Education meeting that stretched more than four hours, a proposed renovation of the Scarsdale High School auditorium took center stage. On Monday, March 6, 2023—the second of three budget study sessions—options for financing the multimillion-dollar improvement project were carefully considered.

During a Board of Education meeting that stretched more than four hours, a proposed renovation of the Scarsdale High School auditorium took center stage. On Monday, March 6, 2023—the second of three budget study sessions—options for financing the multimillion-dollar improvement project were carefully considered.

Assistant Superintendent Stuart Mattey first led a review of the plan originally put forth: to fund the undertaking via a $4.735 million Transfer to Capital in the 2023-2024 budget. Of this sum, $3.534 million in offsetting funds would be provided by the Debt Service Reserve, sourced primarily from unexpended 2018 bond project balances. The remainder of the money—roughly $1.2 million—would be raised through a tax levy, increasing the 2023-24 budget alone by approximately 0.75%.

A balanced view of this strategy was presented to the Board and attendees, outlining both the advantages and disadvantages. Among the former, improvements to the auditorium would be funded immediately, and there would be no need for a separate proposition or vote. But one main drawback would be that the tax levy would be above the tax cap, which could spark dissatisfaction among votes with the annual budget. Another would be the way in which the Reserve for Debt Service would be used, as a lump sum rather than gradually.

Mindful of these considerations and several others Mattey had outlined, the Board then mulled over an updated recommendation. In the new plan, the auditorium project would be excluded from the 2023-24 general fund budget altogether. Instead, it would be presented as a separate voter bond proposition in May, seeking approval of a $4,735,581 million high school auditorium renovation and the authorization to issue bonds for that amount.

Mattey then went over the plan’s numerous advantages. First, he pointed out, approval of 2023-24 budget would be a separate matter from approval of the auditorium renovation. In addition, since there would be no one-time $1.2 million budget impact, a corresponding tax levy increase would be unnecessary. The project’s costs would instead be spread over multiple years, more in keeping with its useful life. Overall, the impact to the tax levy would be less immediate and severe than in the previously proposed plan. Mattey presented the risks of this approach as well, namely that voters might reject the renovation project, and that the total cost of the project would increase due to the expenses of bonding, as well as rising interest rates.

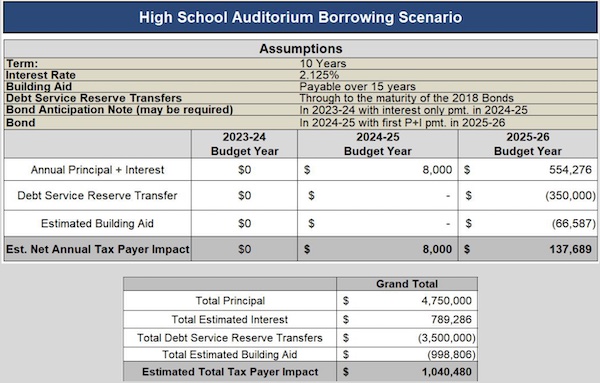

The slide above was presented to summarize the borrowing scenario. The next annual taxpayer impact initially would be zero, and then rise to $8,000 and $137,689 in the 2024-25 and 2025-26 budget years, respectively. Factoring in the principal, total estimated interest, total debt service reserve transfers, and total estimated building aid, the estimated total taxpayer impact would be $1,040,480.

The slide above was presented to summarize the borrowing scenario. The next annual taxpayer impact initially would be zero, and then rise to $8,000 and $137,689 in the 2024-25 and 2025-26 budget years, respectively. Factoring in the principal, total estimated interest, total debt service reserve transfers, and total estimated building aid, the estimated total taxpayer impact would be $1,040,480.

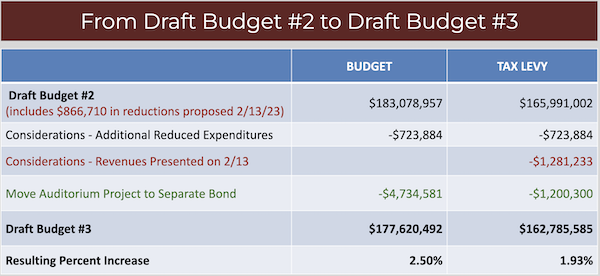

The Board and school administrators next turned their attention to the 2023-24 budget at large. At the previous study session, the Board had requested school administrators to devise an updated school budget to stay below the mandated tax cap of 2.89%. In response, the administration had created another draft, which it detailed for the Board and meeting attendees. The new approach would postpone a number of items and planned efforts to the next cycle, spanning the gamut from technological to building improvements. Along with reductions in curriculum and leadership consultants, plus minor trims to music and phys ed staff and textbook purchases, the cuts would be in the hundreds of thousands of dollars. Together with $866,710 of reductions proposed during the Board’s meeting on February 13th , the new budget would entail a tax levy increase of 1.93%. After much discussion, the Board resolved to follow this plan, which would also involve making the auditorium project a separate bond proposition presented to voters.

Following a brief cabinet update, public comment was invited. Alissa Baum, President of the League of Women Voters of Scarsdale, introduced herself. “I just have a few questions,” she said. “On revenue considerations, you spoke about the higher-than-normal increase in the health insurance reserves. Are there any risks to adjusting revenue using the TRS and health insurance reserves? Do you anticipate needing to use these reserves to just provide revenue for the 24-25 budget? [Regarding] CPSE staffing, what if any costs are associated with a deferral of the CPSE staffing reorganization, especially in terms of potentially higher costs associated with delayed or reduced services for students? [Regarding] consultant reductions, more specifically, how will the reduction in DEI consultant expenses specifically change the current DEI work plan over the next couple of years? Both with respect to [DEI expert and consultant] Doctor [Derrick] Gay's work and work in the classrooms, how will it affect teacher training in this area? And lastly, the auditorium project. Will be auditorium project be on the same timeline, whether it's included in the budget or a bond? Will the one-million-dollar taxpayer impact be distributed over fifteen years?”

Longtime Scarsdale resident Bob Harrison, who had previously interrupted the Board’s budget discussions in an attempt to interject his own thoughts, stood first. “I'm very disappointed that you did not ask for public comment on your budget discussions,” he said. “Why should we sit out here and not have a chance to comment? It doesn’t make sense. At the Village Board meetings, the mayor opens up the meeting to the public that are in attendance. Do you want to hear from us or not?” He then asked what the school is doing with its funds relative to interest income. Among his other demands was for a more granular breakdown of the budget’s impact. “I want to know what's the projected increase for our taxpayers individually,” he said. (Tangent to the subject, the Board later approved a previously discussed tax exemption for seniors.)

High school senior Juliette Schneider spoke next, urging the Board to support a student-led initiative, Westchester Green County. “We have the goal of making all schools in Westchester County carbon neutral, and eventually net zero,” she explained. After briefly explaining the program’s basics, she invited future discussion.” I lot more to say about this work,” she promised.

The school’s energy use was the subject of the next commentary, led by two representatives of a company called Cynergistics. It hopes to partner with the district in reducing energy consumption and expenditures among the schools, resulting in significant savings. The presentation was well received by the Board and administrators, who promised to consider the idea further. Commented Board of Education member Ron Schulhof, “We want to teach our children to take care of the world.”