Installment Billing Offered for School Taxes: Note Printing Error on Bill

- Category: The Goods

- Published: Wednesday, 02 September 2020 09:33

- Joanne Wallenstein

This year, for the first time, Scarsdale taxpayers will have the option of paying their school tax bill in two installments – with the first payment due by September 30, 2020 and the second by January 31, 2021. The Village Board opted to go this route to offer relief to residents who may be feeling financial stress due to the pandemic.

This year, for the first time, Scarsdale taxpayers will have the option of paying their school tax bill in two installments – with the first payment due by September 30, 2020 and the second by January 31, 2021. The Village Board opted to go this route to offer relief to residents who may be feeling financial stress due to the pandemic.

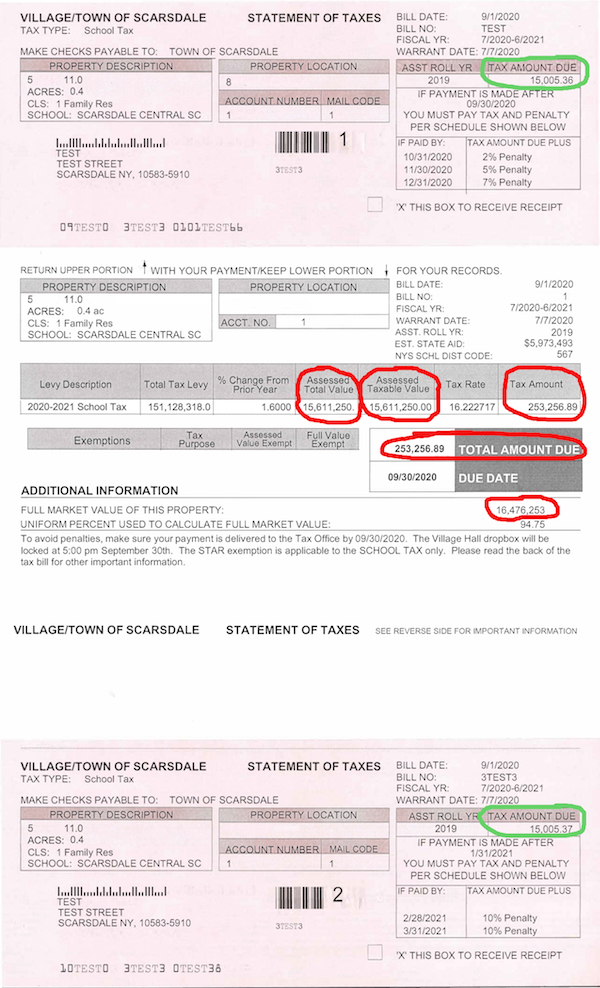

Residents will receive their tax bills this week – however, there is an error on the bills in the white portion of the bill that you retain for your records. The two payment coupons are correct. The two pink payment stubs are to be returned with your tax payments. The white portion that shows your assessed value, full tax amount and market value of your property are incorrect and should be ignored. If you want to see those values, go to the Property Information page of the Village website here and look up your address.

Here is the explanation Scarsdale Village:

Due to an error in the School Tax Bill printing system, which does not impact the integrity of the underlying property tax database, only the two pink payment coupons on the recently mailed school tax bills reflect the correct school taxes owed. Please refer to the “Tax Amount Due” on each pink coupon for the correct amount to pay. Importantly, due to the printing error, fields in the white summary portion of the tax bill containing assessed valuation and total tax information are not accurate. Again, the underlying property tax database’s integrity was not impacted by the printing system error. Please remit only the amounts appearing in the “Tax Amount Due” on each pink coupon, which are accurate and based on a property’s correct assessed value. Taxpayers wishing to verify the correct assessed value and tax information for their property may do so online using the Property Inquiry.

The info circled in red shows the error. The info circled in green is accurate and represents the correct amount due on each payment stub – both stubs are correct.

To reiterate, the underlying property tax database’s integrity remains intact – taxpayers can review the accurate information online using the Property Inquiry.

Here's a sample bill showing the erroneous input circled in red and the correct portions circled in green: