Board of Trustees Continues to Deal with Fallout from 2016 Revaluation and more from Village Hall

- Thursday, 29 September 2016 16:30

- Last Updated: Friday, 30 September 2016 14:39

- Published: Thursday, 29 September 2016 16:30

- Joanne Wallenstein

- Hits: 6394

The Scarsdale Board of Trustees continued to consider a range of issues surrounding the 2016 revaluation at their meeting on Tuesday night September 27. Members of the audience brought up their own assessments, called for Village Assessor Nanette Albanese to be dismissed and questioned the decisions of the Board of Assessment Review.

The Scarsdale Board of Trustees continued to consider a range of issues surrounding the 2016 revaluation at their meeting on Tuesday night September 27. Members of the audience brought up their own assessments, called for Village Assessor Nanette Albanese to be dismissed and questioned the decisions of the Board of Assessment Review.

Here is what was discussed:

Equalization Rate:

First, the Village has retained a consultant to consider a challenge to the 89.06 equalization rate that was assigned to Scarsdale. They have hired Mr. Laurence Farbstein of Latham New York to review property assessments to see if Scarsdale can be assessed at 100% of market value rather than 89.06. The Board will consider a formal appeal of the equalization rate after they hear back from the Office of Real Property Tax Services (ORPST.) If the rate remains at 89.06, Scarsdale's portion of the county tax could go up, but that is yet to be determined.

Phase-In of Tax Increase:

The Scarsdale Town Board of Trustees will consider proposed legislation to phase-in real estate tax increases for qualified residents over a three-year period. The legislation, which would need to be passed by both the NYS State Legislature and Senate, would spread the impact of tax increases over three years to ease the burden on those hardest hit.

Greenburgh passed similar legislation following their recent revaluation and opted to allow those who had more than a 25% increase and were STAR eligible to qualify for the phase in. To be eligible for STAR the subject must be the homeowner's primary residence with a combined family income of less than $500,000. Qualified residents must also have a certificate of occupancy, be up to date on their taxes and have no changes in the value of their homes due to physical changes in the property.

However, the savings for qualified residents would mean an increase in the burden for the balance of taxpayers in Scarsdale. The Village staff did some estimates and found that only 128 households would be eligible for the phase in, which would mean that on average, the balance of taxpayers would pay $92.92 more in year one and $46.40 in year two.

The Board of Trustees will consider the resolution at a future committee meeting on October 13 at 6 pm when there will be opportunity for the community to provide feedback.

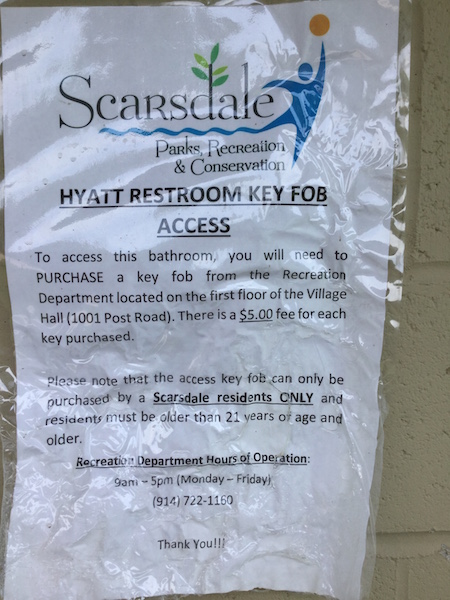

Hyatt Park Comfort Stations:

In other business, Deputy Mayor Marc Samwick, speaking for Mayor Jon Mark, relayed that $2,000 worth of damage had been done to the new bathrooms at Hyatt Field Park which were vandalized. The village will undertake repairs, and in response to an article on Scarsdale10583 about the fact that the bathrooms are locked and only available for use by Scarsdale residents who buy a key fob, will also reach out to the neighborhood for feedback to see if that policy should be changed. They will consider leaving the bathrooms open during the day so that everyone in the park can use them.

Speaking during the public comments portion of the meeting, the following people commented.

Petition to dismiss the Assessor:

Bob Harrison read a statement from Mayra Kirkendall Rodriguez introducing a petition to dismiss the assessor that is posted beginning on page 80 of the agenda of the Setpember 27 meeting on the Village website and has 130 signatures. The statement calls Albanese "unfair" and "rude," and says she "derides residents" and was too "cozy" with J.F. Ryan.

Bob Berg offered the following comment:

The proposed Resolution to Seek Authorization from the Legislature to Phase In the Ryan Reval Tax Increases for Certain Qualifying Property Owners is a really bad idea.

The resolution seeks to put a small Band-aid on a gangrenous limb that, instead, needs to be amputated. The fatally flawed Ryan reval needs to be invalidated – not triaged.

If you are going to seek special legislation for Scarsdale from the State legislature and the Governor, then ask for meaningful legislation. Ask the legislature to allow the Village to annul the Ryan reval because it completely failed to meet the goal of assessing properties at 100% fair market valuation.

Lobby the legislature to give the Office of Real Property Tax Services enforcement authority to make sure that municipalities conduct revaluations properly and to give the ORPTS the power to void them when they don't.

Use our political capital wisely to move towards the goal of the equitable distribution of Scarsdale residents' outrageous tax burden. Don't use it to foist the tax burdens of one small group of residents onto the backs of the rest of Scarsdale taxpayers.

You seem to be fond of doing that – twice in the last four years you have perpetuated the massive tax break that Christie Place condo owners get every year at the expense of every other owner of residential property by unanimously refusing the adopt the Homestead Tax option in connection with each of the two revals.

And you are considering doing so again with this ill-conceived proposal.

Scarsdale residents want our properties to be valued fairly so that the property tax burden is distributed fairly. We don't want to create special tax benefits for Christie Place condo owners and for certain STAR eligible property owners who have been hit hard by the Ryan reval.

We have all been negatively affected by the Ryan reval, even if our property values were decreased. Confidence in our Village government has been decimated. Capital projects requiring bond referenda are in serious jeopardy.

After three months of community uproar over the disastrous Ryan reval, you remain tone deaf to the community chorus. Forget this ridiculous resolution. Ask the legislature to allow us to invalidate the Ryan reval and reinstate the 2015 assessment roll.

Ron Parlato questioned the qualifications of people who are on the Board of Assessment Review. He argued that he "doesn't think the BAR has the tools the need. He said, "They need professionals to make these decisions. I don't agree with their decisions. I think we need the proper people to help the BAR."

Parlato continued, "I received an appraisal of $4.8 million – but the BAR brought mine down from $6.2 million to $6. Now I have to go back to the court and split the savings with an attorney."

He complained, "The assessor is ignoring the deed restrictions on properties in the Heathcote Association. The assessor is ignoring us, why?"

He also questioned the salaries paid to the people who work in the assessor's office and the number of people who work there. He asked if the assessor's salary could be reduced for failures on the job. He told the Board that Nanette Albanese, the Village Assessor, had a "bad slant" on the wealthy residents and should be dismissed. "Get rid of a person in this town who has destroyed the fabric of our real estate."

Norm Bernstein told the Board that if they considered phasing in the tax increases for qualified residents they should also phase in the tax decreases for those who received reductions. He said that he would consider suing the Village if they only gave the benefit to those whose taxes had gone up more than 25%.

The Personnel Committee of the Board of Trustees is also seeking candidates to fill the following vacancies:

The Personnel Committee of the Village Board of Trustees has announced vacancies on the following Boards/Councils/Committees:

• Board of Architectural Review

• Cable Television Commission

• Conservation Advisory Council

• Advisory Council on Human Relations

• Scarsdale Arts Council

• Ad-Hoc Committee on Communications – New Committee -Submission Deadline for this

Committee is Friday, October 7, 2016

Trustee Jane Veron, Chair of the Personnel Committee, encourages residents to apply for these positions by submitting their names, together with a listing of community service and relevant professional background. It is also helpful for Scarsdale residents to recommend other residents for consideration. Applications may be submitted in one of two ways:

• Via the Village Website – At www.scarsdale.com, click "read more" under

* Volunteers Needed for Boards and Councils (located under Village News on the home page). Then scroll down and complete the on-line application form, following the on-screen instructions.

• Via Village Hall – Applications are available in-person or online and should be directed to Trustee Jane Veron at Village Hall, 1001 Post Road, Scarsdale NY 10583.

To review the guidelines for membership, terms of office, and member responsibilities for Scarsdale's Citizen Boards, Councils, and Committees, visit the following link: http://www.scarsdale.com/Default.aspx?tabid=199

Please contact the Village Clerk, Donna Conkling, at 914-722-1175 or via e-mail dconkling@scarsdale.com for further information.