Teaching Children the Value of Money

- Thursday, 21 May 2015 13:01

- Last Updated: Thursday, 21 May 2015 13:05

- Published: Thursday, 21 May 2015 13:01

- Stacie M. Waldman

- Hits: 6341

Most parents don't want their kids to think that "money grows on trees," so to speak. So what and how do we teach our kids about money and at what age should we begin? How should we be teaching our children to use the money they earn, whether from the tooth fairy, as an allowance, or from generous grandparents?

Most parents don't want their kids to think that "money grows on trees," so to speak. So what and how do we teach our kids about money and at what age should we begin? How should we be teaching our children to use the money they earn, whether from the tooth fairy, as an allowance, or from generous grandparents?

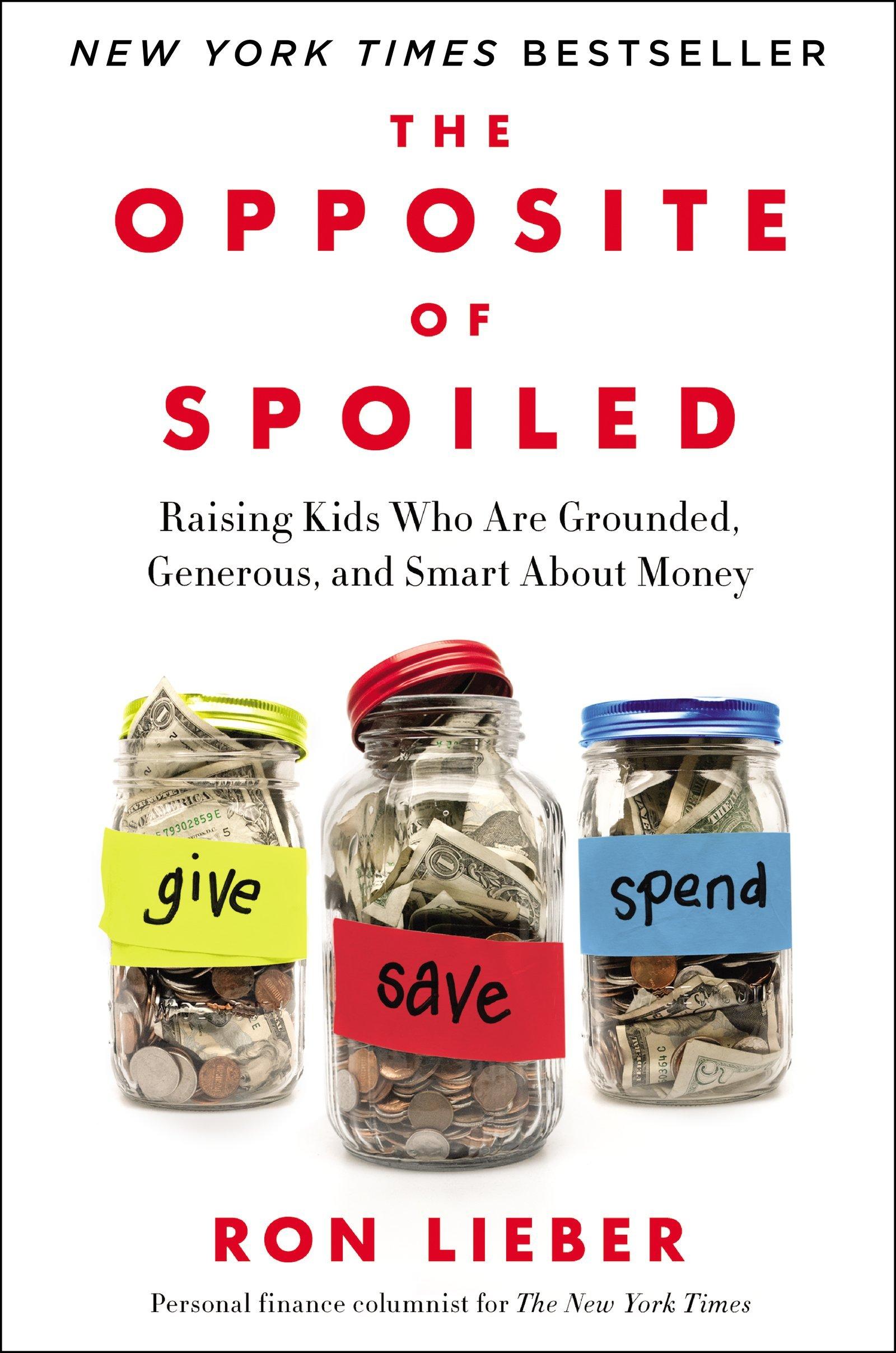

Ron Lieber, an author and a NY Times columnist on the subject of money, recommends that parents offer their children three options:

Give your money to others less fortunate, (and as D.H. Lawrence wrote, "Money poisons you when you've got it and starves you when you haven't,")

Save your money for something they will want in the future unknown or even for college:

Spend it – and carefully choose how.

Lieber who is the author of "The Opposite of Spoiled," a guidebook for teaching your kids about money spoke at the Scarsdale Library on Monday May 11th, and enumerated on his advice to "give, save, or spend"

Lieber explained that he benefited from financial aid to pay for his college education and learned to  work the system to his advantage. Upon graduating, he went to work for the Wall Street Journal where he wrote about "beating the system," and gave his readers money-saving tactics such as returning their wedding gifts for cash. He left a few years later for The New York Times and became a parent shortly thereafter. At the age of three, his daughter started asking questions about money, wondering why the family did not have a summer house and a basement full of toys. Parents began contacting him about his New York Times blog and invited him to their communities to speak to people with more and less money in order to work out their differences.

work the system to his advantage. Upon graduating, he went to work for the Wall Street Journal where he wrote about "beating the system," and gave his readers money-saving tactics such as returning their wedding gifts for cash. He left a few years later for The New York Times and became a parent shortly thereafter. At the age of three, his daughter started asking questions about money, wondering why the family did not have a summer house and a basement full of toys. Parents began contacting him about his New York Times blog and invited him to their communities to speak to people with more and less money in order to work out their differences.

Lieber concluded that out that parents in the top 1% and the remaining 99% all have this in common: No one wants to raise a spoiled child. But what's the opposite of spoiled? he asked himself.

Mr. Lieber threw out a list of the attributes that most parents seek to instill in their children: modesty, curiosity, generosity, perseverance, prudence, grit, thrift, and patience.

Rather than avoid the conversation about money, he said, "What if we embraced the questions and used the answers to steer our kids on how to save and spend that lead to those attributes? Mr. Lieber thinks parents should promise their children to do a better job conversing about money than their parents did with them

"The business of the family, revenues and expenses, are part of the family dynamic," Mr. Lieber argued. "Instead of telling kids that questions about money are none of their business, why not honor their curiosity and ask why they want to know?" He suggested that kids may be confused or anxious about money and that parents should help them understand the important role that money plays in our lives.

According to Lieber, the basic foundation for being a fiscally responsible adult is giving, saving and spending. When thinking about the values that parents want to instill in their children, spending incorporates modesty, prudence, and thrift; saving helps one learn patience; giving helps one to learn gratitude, generosity, and graciousness. "Kids have the ability to understand this, even at the young age of 5 or 6," Mr. Lieber suggested. "Try to tell a personal story that your kids can relate to --like giving to a charity, financial aid you received at college, or buying your first car with the money you saved from babysitting."

He encouraged parents to give kids an allowance by the ages of five through seven, "...maybe a buck for every year they are." He suggested dividing it between three jars labeled "give, save, spend." He cautioned parents NOT to connect allowance to chores as chores are important for and should be expected of all kids, "...for their own benefit, believe it or not."

Mr. Lieber recommended that parents use the "want-need continuum" to keep their kids (and themselves!) in check. He used the example of rain boots. "On one end of the continuum you might have Hunter boots for $120 (an expensive luxury), and on the other end you could have Payless boots for $19.99 (perhaps not well-made, but practical). In the middle there are sturdy Land's End rain boots for around $60." Recognizing that teens want the brand named Hunter boots he asked the audience whether they would buy these for their teens. "On the one hand," he said, "you need rain boots to keep feet dry in the rain. On the other hand," he continued, "do you really need $120 rain boots, or would $60 quality rain boots suffice?" Mr. Lieber said that to teach your kids the value of money, you could give them the $60 you would probably spend on a pair of rain boots, and tell them to come up with the difference if they want to buy the Hunter boots.

Mr. Lieber said this will help kids understand why you'll spend money on one thing and not on another. Instead of fighting over the value of something, you can decide the reasonable amount to spend and let the child determine how much they feel something is worth. "Explain to them and define for them a want versus a need," Mr. Lieber added."

Lieber said that it is important to teach children the value of giving. He taught his own daughter about giving using beans – and placing different numbers of beans (representing X dollars) on pieces of paper that contained the names of the charities or organizations to which they gave. He asked his daughter if there was anything missing, and she thought that kids should have the opportunity to go to sleep away camp even if it wasn't affordable for their families. "So that first year we gave her 5 beans towards a camp scholarship fund," he said. "The next year she got 7, and so on. In this way, she contributed to giving as a family."

Mr. Lieber added that one of the best things parents can do for kids is to send them to sleep away camp. "It gets them away from technology and the stresses of the school year, both social and academic." He talked about a camp on an island in Maine that has no electricity or showers. The kids bathe in the lake. "But let's also make clear that this camp," added Mr. Lieber, "has quite a few kids from New Canaan, CT." They leave their comfortable houses and go summer after summer to this camp. "The fun they have is the fun they create, so they all need each other to create the fun," he said. "STUFF doesn't create fun. Companionship, teamwork, and things like that DO," he argued.

"Spending money on experiences is the best way to achieve happiness," Mr. Lieber suggested, "not on stuff." He used, as an example, a hard-working couple that took their kids to Four Seasons resorts all over the world. Although it was enjoyable for them, they also felt like they were limiting their children's experience to a very cloistered world. "If you're lucky enough to do that type of vacation," he said, "you should consider mixing it up with a different type of vacation. Or if you go super-luxe for your vacations, try doing it the local way for a bit. Take the bus, talk to the people who live there, and show your kids the reality of the way the rest of the world works."

Lastly, Mr. Lieber spoke about saving and how it is related to the ever-increasing cost of college. At age 17, it's very difficult for a child to understand the cost of tuition, and hard to calculate the pros and cons of going to a $100,000 state school versus a $250,000 private school. No studies have been done to show that attending the higher price-tag school will benefit a student more than the state school, but the debt and/or cost will be more than double for the private school.

Mr. Lieber wrapped up his talk by speaking of the "fun ratio," reminding parents that kids need to make mistakes with money because it's the best way to learn not to do it again. "We'd rather kids do it under our roof than in the real world. Remind them of things they spent money on before that didn't end up being a good value." A tangible lesson is the best lesson. Older children can actually take the dollars spent and divide it by the number of hours they spent playing with or using something to determine the so-called "fun ratio" and be reminded of it for their next financial decision.

Pick up a copy of "The Opposite of Spoiled" to learn more --and to feel good about the core values you are instilling in your kids.