Mayor Explains Village's Defense Against Article 78 and Laws Regarding Financing Road Repair

- Thursday, 02 March 2017 15:28

- Last Updated: Thursday, 02 March 2017 15:47

- Published: Thursday, 02 March 2017 15:28

- Joanne Wallenstein

- Hits: 6288

It's a curious situation: Those who filed the Article 78 against Scarsdale Village are now grousing about the cost to the Village – and therefore residents - for the defense. The Article 78 called for two remedies – one to void the 2016 revaluation and reinstate the 2015 tax roll – or if not, to reimburse the 155 petitioners for the difference between their taxes on the two rolls.

It's a curious situation: Those who filed the Article 78 against Scarsdale Village are now grousing about the cost to the Village – and therefore residents - for the defense. The Article 78 called for two remedies – one to void the 2016 revaluation and reinstate the 2015 tax roll – or if not, to reimburse the 155 petitioners for the difference between their taxes on the two rolls.

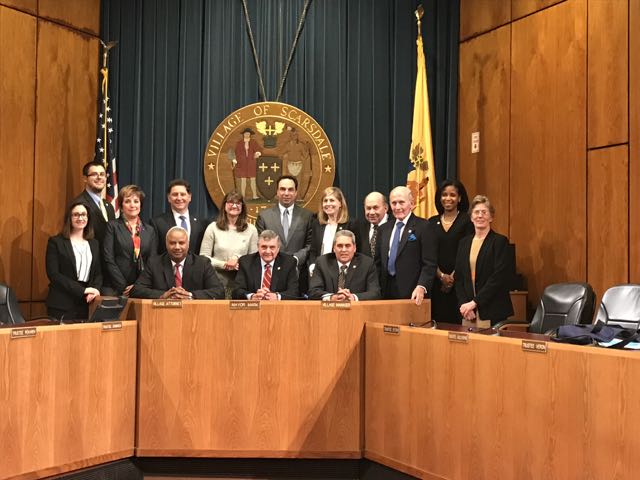

When the Mayor and Village Attorney explained why neither option was practical or legal, the petitioners then urged the Village to settle the suit. At the February 28 meeting of the Board of Trustees, Scarsdale Mayor Jon Mark offered the following explanation as to why the Village filed a motion to dismiss the Article 78:

He said:

1. This Board represents all of the Village residents. The petition ignores the fact that the vast majority of those residents have not formally complained about the revaluation for a variety of reasons.

2. Reinstating the 2015 roll, even if legally possible, would deprive those who did not grieve in 2015, but who might wish to do so, the inability to pursue

that remedy. We have made this point before and it was also part of an observation made by a resident during the public comment portion of a prior Board of Trustees' meeting.

3. The central element of the relief sought -- an order directing this Board to void the 2016 reassessment roll is not an action the Board is legally authorized to take on its own.

4. Even if the 2015 assessment roll was reinstated, the administrative chaos it would create is potentially enormous. It would require not only the Village, but the School District and the County to re-set their tax rolls. For the County, that process would implicate not just Scarsdale, but would involve recalculating the allocation of County taxes among all 43 other municipalities in the County. It would also involve refunds and re-billings to virtually all residents at the Village, School District and County levels. The administrative complexity would likely be costly for all taxpayers including those already claiming hardship. The fiscal chaos that such a process could create is a factor to be considered in light of the alternatives already provided by the law.

5. Specifically, there is a clear, well-outlined statutory remedy available to property owners who believe they have been over-assessed -- that is, the grievance process. For those who do not presently have unresolved grievances pending, a 20-day period during which grievances can be filed will open on June 1, 2017.

6. The Board understands that the grievance process does not address a sense of unfairness in the case of properties that may be perceived as being under assessed.

7. However, there is a straightforward means for addressing that issue and the other issues raised by the 2016 revaluation. Do another Village-wide revaluation, even if some may still be unhappy with the result. I have no doubt that that will occur and be executed in a thoughtful and transparent manner. However, until some organizational assessment of the functioning of the Assessor's Department is done, it is likely that community confidence in another revaluation would be undermined. This Board met earlier this evening to hear a presentation of such an assessment and has taken under advisement whether and how to proceed with such a project.

There is a belief among some that not defending against the Article 78 would somehow bring closure to the issues raised by the 2016 revaluation. We disagree. To the contrary, since this Board lacks the legal authority to do what the petition seeks, the pendency of the petition will simply prolong a period of uncertainty in

the real estate market in Scarsdale and for residents trying to make financial plans. There is simply no legal authority for what the petitioner seeks in the way of relief. These matters have cost us all an inordinate amount of time, effort and money. Time that might have been spent focusing on other Village issues – such as land use and sustainability to name two. To date, the Village has incurred $12,350 in legal expenses with respect to the Article 78 matter. It goes without saying, but I will say it: this is not what I would have wished for us all when I started my term as Mayor. But here we are and it is still my hope that we can work through this difficult issue together.

These matters have cost us all an inordinate amount of time, effort and money. Time that might have been spent focusing on other Village issues – such as land use and sustainability to name two. To date, the Village has incurred $12,350 in legal expenses with respect to the Article 78 matter. It goes without saying, but I will say it: this is not what I would have wished for us all when I started my term as Mayor. But here we are and it is still my hope that we can work through this difficult issue together.

In the Public Comments section following Mark's statement, Robert Berg, a candidate for Mayor who is sympathetic to the opponents of the 2014 revaluation questioned the Village's decision to defend themselves rather than settle. He said, "I am not involved in the Article 78 but now I am saddled with paying the village's defense. Why has the village hired two separate law firms? How much has the Village budgeted for the defense of the action and how much has it spent defending the action?"

Mayor Mark responded, "We have spent $12,350 per date.. that's roughly $2.12 per property owner."

Berg then pressed for the hourly rate for each of the attorneys and was first told to file a FOIL request, but then Village Attorney Wayne Essanason volunteered that the fee was about $225 per hour and that billing is done on an hourly basis.

Berg then wanted to know, "Is that fee capped? Most firms agree to cap fees. How much will this cost?" Village Attorney Wayne Essanason then explained that it was difficult to predict how much the defense would cost because it would depend on the judge's decision. Essanason said, "My budget each year is $200,000 and we usually don't spend that. We do a lot of the defense in house. In instances where there is a specialized skill involved we hire outside counsel."

Later in the meeting Trustee Bill Stern defended the Board's actions, saying, "The court should decide on the lawsuit. It would be irresponsible and reckless if we did not respond to the lawsuit." Referring to the 35,000 FOIL requests for emails filed by opponents to the 2016 revaluation, Stern said, "The sheer number of FOILS cost us south of $100,000. While we support the idea of FOILS, people should bear in mind that they come at a cost. We tried to do what we could about the reval under the law."

Road Repair

A discussion about the repair of Scarsdale roads, brought more confrontation.

Mark answered critics who had asked the Village to post bonds to do a full repair of all of Scarsdale roads. He contended that NYS local finance law limits the term of the bond to the useful life of the project. Therefore, since roads last only ten years, the term of the bonds cannot exceed ten years and the debt service would be steep.

He said:

".....First, let me be clear. None of us are satisfied with the condition of some of our roads, including the ones we hear about from residents. In considering what to do about the situation, the principal issue to be addressed is a budgetary one. Secondarily, there are logistical issues as to how much – how many miles – of the roads can be re-surfaced in one season.

Turning to budgetary matters first. There are approximately 79 miles of Village- owned roads. Note that certain roads that run through Village such as the Post Road, Weaver Street, the Heathcote By-pass and Palmer Road are state and county roads and so the Village does not have control over repairs on them. Note also that most of our roads are not in horrible condition. Sweeping statements that imply all 79 miles of Village roads are presently in need of re-paving tend to overstate the problem. Therefore, for hypothetical purposes, let us assume we wish to re-surface 10 miles of the roads most in need of attention.

The estimated cost of repaving a mile of road ranges from approximately $350,000 to $500,000. Among the variables affecting the cost include the condition of the underlying road bed – whether due to its age it has to be re-built or not – and whether the road has curbing that needs to be re-set, or have new curbing installed. For purposes of example, using the lowest average cost mentioned above, it would cost $3,500,000 to resurface 10 miles of roads. Assume then, that funding would be provided by a $3,500,000 Village bond. Under the New York State Local Finance Law Section 11.00, the term of the bond would be limited to the probable useful life of the project being financed. In the case of the Village roads, the applicable period is a maximum ten years. Thus the term of any such bond could not exceed ten years. What would be the impact of the bond issue on the Village budget? Municipal debt is required to be amortized on a straight-line basis. For ease of calculation in this discussion, let's ignore the interest portion of the debt which would otherwise have to be factored in. Amortizing the ten-year bond would therefore add approximately $350,000 per year of debt service cost to our Village budget – actually, somewhat more than that when interest is included. That amount equates to approximately 1% of tax rate to put it into context.

For those who remind us of the importance of long-term financial planning, it is noted that it is not considered good planning to borrow long to solve a currently recurring problem. Pot holes, road restoration after utility service repairs and more general road deterioration are on-going annual maintenance issues. While the degree of deterioration varies year-to-year, road repair can be counted on as a hardy perennial."

Berg is running for Mayor on the Scarsdale Voters Choice slate and has made road repair a campaign promise. On the party's website it says, "Repaving a road to last thirty years is a capital project. The only way we will ever make headway to improve our roads is to issue municipal bonds to pay for this fundamental Village service." Berg has also promised to keep the tax increase below the tax cap, which would make it difficult to take out bonds to finance road repair.

After listening to the Mayor's remarks, Berg challenged Village Manager Steve Pappalardo to produce a report on the condition of all Village roads. Berg said that the NY Thruway Authority issues bonds for road repair and said he thought we should embark on a strategic program for road repair using low cost municipal bonds to make headway.

The Mayor responded to Berg repeating the fact that NY State law differs from the laws governing municipalities.

It was clear from the Mayor's remarks, that issuing bonds for road repair would cause the Village budget to far exceed the tax cap or necessitate the elimination of other services.

Watch the entire meeting here.