SFCS Seeks New Board Members

- Details

- Written by: Joanne Wallenstein

- Hits: 745

Are you interested in joining the Board of a non-profit organization right here in Scarsdale? Are you passionate about supporting families and individuals in our community? The Scarsdale Edgemont Family Counseling Service (SFCS) is looking for enthusiastic and dedicated individuals from the Scarsdale/Edgemont community to join our Board of Trustees. As a Board member, you'll play a vital role in guiding and shaping our organization's mission to be a hub for family growth and learning.

Are you interested in joining the Board of a non-profit organization right here in Scarsdale? Are you passionate about supporting families and individuals in our community? The Scarsdale Edgemont Family Counseling Service (SFCS) is looking for enthusiastic and dedicated individuals from the Scarsdale/Edgemont community to join our Board of Trustees. As a Board member, you'll play a vital role in guiding and shaping our organization's mission to be a hub for family growth and learning.

What is SFCS? Scarsdale Edgemont Family Counseling Service is a voluntary, not-for-profit family counseling agency. With over a century of service to the Scarsdale community, SFCS has been a cornerstone, offering counseling services, social programs, and crucial initiatives like our Scarsdale Action for Youth (SAY). In addition to counseling services, the Agency provides social service programs for Scarsdale residents across the life cycle from social skills groups for young children to leadership training programs and adventure trips for teens, to facilitated monthly discussion groups for parents with kids in 5th-12th grades, to aging in place services for older residents.

Why Join Us?

• Make an Impact: Your involvement directly contributes to supporting families at every stage of life.

• Community Engagement: Connect with like-minded individuals dedicated to the betterment of Scarsdale and beyond.

• Personal Growth: Gain valuable experience and insights in nonprofit governance and community leadership.

Who Are We Looking For?

We welcome Scarsdale residents with diverse backgrounds, preferably with children attending Scarsdale schools. We seek residents with relevant experiences who are committed to our mission.

How to Apply: Interested in becoming a part of our Board of Trustees?

Apply by February 1, 2026 by sending a short email with the following information to SFCSNominatingCommittee@yahoo.com

Volunteer/Professional Background/Key Skills

Community Experience in Scarsdale/Edgemont, including ages of children (and schools attending)

Experience with SFCS

CNC Seeks Scarsdale Citizens To Run For Village Trustee

- Details

- Written by: Joanne Wallenstein

- Hits: 2927

The Citizens Nominating Committee is seeking motivated Scarsdale citizens to run for the position of Village Trustee on the Village Board.

The Citizens Nominating Committee is seeking motivated Scarsdale citizens to run for the position of Village Trustee on the Village Board.

If you or someone you know is interested in running for Village Trustee, please have them contact CNC Chair Amy Frank via email at aimster68@gmail.com, or Vice Chair Leon Xin at leonxin@gmail.com to discuss the CNC’s nomination process. The CNC consists of 30 elected Scarsdale residents who have volunteered to interview and evaluate potential candidates to run for Village office. After reviewing all potential candidates, the CNC will endorse three nominees for Trustee and will thereafter assist those individuals’ campaign efforts.

Please note the CNC process is starting in a few weeks. If you are interested please contact Amy or Leon as soon as possible, but no later January 9, 2026.

Garden Road Subdivision, Dolma Road Home and More - from the Land Use Boards

- Details

- Written by: Joanne Wallenstein

- Hits: 1877

Builders continue their campaign to replace Scarsdale’s housing stock. The newly amended building code, which requires Planning Board approval for site disturbances and building in the property buffer and wetlands, seems to be causing more hearings--but applications are approved with revisions.

Builders continue their campaign to replace Scarsdale’s housing stock. The newly amended building code, which requires Planning Board approval for site disturbances and building in the property buffer and wetlands, seems to be causing more hearings--but applications are approved with revisions.

Here are just a few of the proposed projects before the Planning Board and the Committee for Historic Preservation to be considered this month and in the new year.

80, 88 and 90 Garden Road

Most significant, a highly controversial proposal for a subdivision at 80, 88 and 90 Garden Road is back on the agenda. Developers have applied to subdivide three existing tax lots into six, to demolish two existing homes on the site and construct five new homes. Neighbors have vociferously sought to block the project for years due to flooding along Cushman Road, which abuts the site. The Village has proposed several large stormwater abatement projects for the area, but while they seek grant funds for the work, nothing is in process as of yet. The last subdivision proposal, considered in September 2025, called for the removal of over 200 trees and the use of tons of landfill to raise the low -lying terrain by four feet.

At the time, the Planning Board voted to circulate a notice of intent to declare the Planning Board as lead agency for a SEQRA review of the plan. The next meeting will be held on Tuesday January 13, 2026 at 7 pm at Village Hall.

17 Dolma Road

Another interesting case involves 17 Dolma Road. The Committee for Historic Preservation denied an application to demolish the original home on the property. However, the applicant appealed that decision to the Board of Trustees who decided not to defend the CHP and the house was razed. The applicant then proposed a modern glass house to replace the Collett-built Tudor and presented plans for the home to the Board of Architectural Review on November 17, 2025. They were told to re-design the house as the BAR did not feel it was in keeping with neighborhood character. The Cultural Resource Survey, done by Architectural Historian Andrew Dolkart in 2012, proposed that Dolma Road be named a study area for historic preservation and the proposed home would stand out from those on the street.

Dolkart’s report says, “Dolma Road, running from Murray Hill Road to Birchall Road, is a short street lined with exclusive houses on large lots, most erected between 1926 and 1929 (one dates from 1935), primarily for wealthy businessmen and their families (Figure 7-10-1). Dolma Road was largely a project of Walter J. Collet, the Scarsdale builder who was responsible for the construction of many substantial houses in the village. Collet claimed that he chose the name Dolma in reference to a mountain range in Bengal, India; just w hy he made this choice remains a mystery. Along Dolma Road, Collet appears to have been not only the builder, but also the developer. Collet worked closely with the architect Eugene J. Lang, who designed nine of the fifteen houses in the study area. Collet remained the builder of the houses designed by other architects. The Dolma Road. houses are large buildings in the American, English, French, and Spanish styles so popular throughout Scarsdale in the 1920s. Among the wealthy owners w ere life insurance dealer George Hofmann (No. 2); publishers (and, apparently, brothers-in-law) Frank Braucher (No. 4) and Frederick Dolan (No. 6); tobacco merchant George Cooper (No. 8); W. Wallace Lyon (No. 11), W all Street broker and insurance man; Alden C. Noble (No. 15), chairman of the board of the Merchants Fire Assurance Corporation; Dr. L. T. Webster (No. 17), a noted epidemiologist at the Rockefeller Institute; and J. Arthur Bogardus (No. 21), chairman of the board of the Atlantic Mutual Insurance Company.

The study area contains several very large Colonial Revival houses, including four of red brick – the Robert W. Keelip House at N o. 5 (Eugene J. Lang, 1929; Figure 7-10-2), resembling a James River plantation, and the New England-inspired George Cooper House at N o. 8 (Eugene J. Lang, 1926; images of the house were published in The Architect, April 1928, pp. 109-13), Edward Y. Baker House (Rich & Muthesius, c. 1928) at 26 Murray Hill Road, a part of the Dolma development, and J. Arthur Bogardus House (Ren ick, A spin wall & Guard, 1935) at N o. 21 (Figure 7-10-3). Tw o stone examples of the style are Lang’s 1927 design for Alden C . Noble at 15 Dolma Road (Figure 7-10-4), modeled on Pennsylvania estates, and his Buck County, Pennsylvania farmhouse of 1928 at 18 Dolma Road for Herman van Fleet (Figure 7-10-5). Lang designed a curious clapboard house in 1928 at 30 Murray Hill Road, with a projecting gabled pavilion supported on the side by monumental, attenuated, square piers (Figure 7-10-6).”

Despite the area’s historic significance, the attorney from Cuddy and Feder for 17 Dolma Road is appealing the BAR's decision and modifying the plans to shield the view of the modern glass house from the street.

Specifically, they plan to address the Village’s feedback by shifting the driveway and planting trees.

They say:

-The driveway was shifted to the east to limit the visibility of the home from the street;

-A row of 16-foot tall arborvitae is provided at the front property line to further limit the visibility of the proposed home from the street (see Sheet T-1.3);

-A sight line diagram is provided to demonstrate that the proposed plantings will screen the new home.

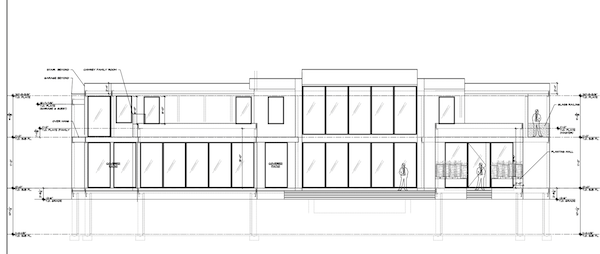

Proposed New Home at 17 Dolma Road.

Proposed New Home at 17 Dolma Road.

Addressing the BAR comments about the appropriateness of the design, they say the structure is consistent with modern structures in the Village, in conformance with other contemporary residences approved by the Village and that “the Village is obligated to adhere to past precedent when considering similar design proposals. As such, the Board should approve this Application seeking the same type of home that was approved previously. New York courts hold that, regardless of any change in member composition, a determination of an administrative agency or body that “neither adheres to its own prior precedent nor indicates its reason for reaching a different result on essentially the same facts is arbitrary and capricious” and will be annulled by the courts.”

The Planning Board will consider this application on December 17, 2025 at 7 pm.

See the agenda and applications here:

115 Lee Road An application has been filed to raze this craftsman/bungalow style home at 115 Lee Road.

An application has been filed to raze this craftsman/bungalow style home at 115 Lee Road.

An application to raze a craftsman style home and garage at 115 Lee Road, which was built in 1918 has been filed before the Committee for Historic Preservation. The home is nicely set back from the street and appears to be well preserved. Whether or not it can be considered historically significant will be considered by the committee on Tuesday December 16, 2025 at 7 pm.

SBNC Election on Wednesday, December 3

- Details

- Written by: Joanne Wallenstein

- Hits: 649

Dear Scarsdale Community,

Dear Scarsdale Community,

The SBNC Election Chairs would like to remind you of the upcoming School Board Nominating Committee (SBNC) election on Wednesday, December 3, and encourage your participation in this important community process. SBNC is an elected volunteer group of residents whose role is to recruit, evaluate, and nominate candidates to fill vacancies on the Scarsdale Board of Education.

The election will take place at Scarsdale Middle School (Auditorium Lobby) during the following hours:

7:00 AM–10:00 AM and 2:00 PM–9:00 PM

Scarsdale residents who are 18 years or older are eligible to vote. If you are unable to vote in person, you may also submit a mail-in ballot.

For more information on eligibility, mail-in ballot instructions, and candidate details, please click here.

Jocelyn (Gibian) Zoland and June (Xun) Deng

PT Council Poses Budget Questions to the School Board

- Details

- Written by: Joanne Wallenstein

- Hits: 799

(This statement was read at the November 17, 2025 meeting of the Scarsdale Board of Education, by the PT Council Budget Study Co-Chairs)

(This statement was read at the November 17, 2025 meeting of the Scarsdale Board of Education, by the PT Council Budget Study Co-Chairs)

Good evening.

We are the Scarsdale Parent Teacher Council Budget Study Co-Chairs this academic year, Mayra Kirkendall-Rodríguez and Rachana Singh. Since September, we have been communicating with the PTC and PTAs and appreciate their engagement. Even more so, we have happily dedicated many hours to reaching out to individual parents and taxpayers, via emails, announcements in PTA newsletters, and speaking with them at local community events.

This year, we also sent out a Google Form to facilitate parents’ feedback. And of course, no one on local Facebook sites could have missed our many missives encouraging Scarsdale residents to be part of the budget process.

This is a key year for residents to recognize that the District faces a projected operating deficit. Additionally, proposed capital project bonds are under consideration both within the School District and the Village. Any debt issuance affects servicing costs, which are borne by taxpayers. Another significant challenge for the District is the reliance on the fund balance to prevent even greater tax increases.

Section 1 - Themes and Observations for 2026-2027 Budget

Based on our due diligence, here are our observations and questions:

1. Our most significant fiscal concerns include rising healthcare costs, the projected operating deficit, and the low level of the fund balance. These issues, combined with the proposed capital bond, underscore the importance of transparency in the budget process so that residents can see what the tax impact will be.

2. For many Scarsdale residents, there is uncertainty in determining budget priorities for 2026-2027 and beyond, since they are awaiting clarity on the scale and scope of the proposed bond for capital projects. Additionally, knowing what is included in the proposed capital projects bond would help community stakeholders determine whether anything left out would be a budget priority presently or in the longer-term.

While many parents, taxpayers and we realize that the scope of the bond project is not complete, it is important to understand how this project will affect the budget this coming year and the District’s long term financial plan.

To ensure transparency and fiscal prudence, we recommend that as soon as it is feasible, the District please share with our community the following scenarios for the proposed bond:

● a “tax-neutral” option — approximately $40 million, as referenced by the administration,

● an infrastructure-focused option that includes only Priority One items from the BCS report along with air conditioning which would be above $40 million, and

● the current $108 million bond proposal. (Note: the $108 million was in the presentation we had late Friday; this evening the amount rose to $113m)

3. Various members of the community told us that they would like a detailed rationale for prioritizing investments in our schools.

● For example, parents and taxpayers have asked “why is the District spending on cafeterias, fields, and libraries over investing in more math courses, science labs at the elementary schools and SMS, and/or adding Advanced Placement courses at SHS?”

4. Parents from several schools and the Scarsdale CHILD Committee have stated that an anonymous special education needs assessment survey of parents and teachers, would be valuable to identify what staffing and spatial additions are needed.

Section 2 - Proposed Capital Bond and Budget Planning Impact

As the District considers the proposed capital bond, the community would appreciate understanding how this significant borrowing initiative is being integrated into the long-range budget planning process. Taxpayers will benefit from clarity on how the bond’s debt service schedule will align with other budgetary obligations and existing or anticipated capital commitments. Specifically:

● How does the District plan to model the annual tax impact of the bond — both the magnitude of the increase and the timing of when those increases would appear on the tax bill?

● Has the District projected how this new debt service will affect the overall property tax levy in the first five years following issuance?

● Given that the Village and District are proposing bonds that ultimately draw from the same taxpayer base, how is the District managing overlapping liabilities to ensure transparency and to avoid possible “bond confusion or fatigue” among residents?

Understanding these details will help community stakeholders assess not only the merit of the capital projects, but also the sustainability of the overall tax implications in light of multiple major borrowing initiatives.

Section 3 - Questions and Requests From Previous Years

Last year, the PTC asked the District to assess rising health plan costs and identify what is driving these increases. The new Long Range Financial Plan projects healthcare costs rising about 8% each year over the next five years, which continues to put pressure on both the fund balance and the tax levy.

We are asking for more detail on what strategies the District is exploring to help manage these increases—whether through plan design, cost-containment efforts, investment strategies within the self-insured model, or through future labor negotiations.

The LRP notes that “recent plan and labor contribution changes may improve trends,” and we would appreciate clarity on what those changes are and whether they are showing early results.

We also note that the Health Insurance Reserve, currently $2.85 million, is projected to decline to zero by 2028–29. Once it is depleted, all future health cost increases will need to be absorbed directly by the operating budget.

Given this, we ask how the District plans to manage rising healthcare volatility once the reserve is exhausted, and whether alternative reserve strategies are being considered to help stabilize long-term costs.

Section 4 - Fiscal Questions and Concerns

Because maintaining a high credit rating directly affects the District’s borrowing costs, we have several observations and questions regarding the November 2025 Long Range Plan (LRP), particularly around fund balance, available cash, and leverage (the District’s level of debt).

We are concerned about the District’s operating deficit forecast. If a bond is issued within the next two to three years, the community needs clarity on the combined tax impact of both an operating deficit and debt service.

The District’s current five-year expense forecast projects total expenses of $222 million by 2029–2030—a 21% increase—with instructional expenses up 16% and employee benefits up 28%. Could the District please explain what steps are being taken to moderate these significant projected growth rates?

The current District Long Range Plan forecasts a significant operating deficit for 2029–2030. Please update the community on how the forecast operating deficit could affect the District’s credit rating and borrowing costs, particularly since Bond Anticipation Notes (BANs) and bonds may be issued between 2027 and 2030.

Interest Earnings

With both long-term and short-term rates starting to come down, we would like to know:

● how has the District adjusted its assumptions for interest income in the later years of the five-year plan?

● what reduction in yield is built into those projections, and

● how sensitive are our revenues if rates drop more quickly than expected?

Questions about Fund Balance and Reserves

With the Health Insurance Reserve expected to be depleted by 2028–29 and the unassigned fund balance already at the 4% legal limit, we ask:

● At what point does reliance on reserves become unsustainable?

● What is the District’s long-term plan to rebuild reserves once the Health Insurance Reserve is exhausted?

● How will flexibility be maintained to absorb unexpected costs when reserves decline?

● Has the Board considered setting target levels or replenishment plans for each reserve fund?

● Could the District share an updated model showing how deficits change under varying assumptions for healthcare or wage growth?

Credit Ratings Implications

Scarsdale currently holds a Moody’s AAA rating, which is very important because this rating lowers borrowing costs for taxpayers when the District issues debt. However, with decreases in the projected fund balance since 2020 and increased indebtedness of the District, could Moody’s lower Scarsdale’s rating to AA+? If so, what can the District do to decrease borrowing costs? Higher debt service could influence the community’s and the District’s decisions about what might have to change in the budget, possibly impacting student experiences.

Under Moody’s methodology:

● Fund balance as % of operating revenue (20% of the ratings methodology weighting): Scarsdale is about 13%, below the AAA median of 24% (equivalent to a single A rating on this metric).

● Net cash ratio, a metric to measure an issuer’s liquidity, (10% weighting in the methodology): Scarsdale is around 15%, below the AAA median of 25%.

● Leverage ratio (20% ratings weighting): While currently manageable, an additional $68 million in borrowing, above the $40 million be retired, could raise debt levels enough to affect the District’s overall rating.

All the above factors are half of the methodology, and they are not at AAA for the Scarsdale School District.

Concluding Comments

Thank you for holding this session for residents; we look forward to this months-long budget process and definitely encourage Scarsdale residents to participate in sessions and forums about the proposed budget as well as the capital projects bond throughout the coming months.

PT Council Budget Study Chairs:

Mayra Kirkendall-Rodríguez, PTC Budget Study Co-Chair

Rachana Singh, PTC Budget Study Co-Chair