Keep Spanish Instruction in First Grade

- Details

- Written by: Joanne Wallenstein

- Hits: 5517

Here is a letter to the editor from Scarsdale resident Michael Blumstein: My own children are long past elementary school, but I still feel compelled to articulate my deep disappointment (even embarrassment) that Scarsdale is proposing to reduce the Spanish program, moving its start to second grade from first grade. Many of us fought for years to get this program started, and the need for language skills continues only to increase in our globalizing world. I understand that several elementary school principals have requested this change, citing time constraints. We need the leadership of our school system -- charged with seeing the big picture and taking unpopular stands, when warranted -- to push back and proudly maintain this important and differentiating program. Indeed, many would argue that it should start earlier, not later, if we really want to serve the next generation responsibly and thoughtfully.

Here is a letter to the editor from Scarsdale resident Michael Blumstein: My own children are long past elementary school, but I still feel compelled to articulate my deep disappointment (even embarrassment) that Scarsdale is proposing to reduce the Spanish program, moving its start to second grade from first grade. Many of us fought for years to get this program started, and the need for language skills continues only to increase in our globalizing world. I understand that several elementary school principals have requested this change, citing time constraints. We need the leadership of our school system -- charged with seeing the big picture and taking unpopular stands, when warranted -- to push back and proudly maintain this important and differentiating program. Indeed, many would argue that it should start earlier, not later, if we really want to serve the next generation responsibly and thoughtfully.

Michael Blumstein

11 Wheelock Road

Confidence Betrayed

- Details

- Written by: Joanne Wallenstein

- Hits: 5415

I was very surprised to read the Scarsdale Inquirer's coverage of the purportedly confidential proceedings of the Scarsdale Citizen's Nominating Committee (CNC) in their January 30th edition. This week the CNC announced their slate of candidates for Mayor and Village Trustees, and like the Inquirer, Scarsdale10583 reported that former Village Trustee Jon Mark had been selected for Mayor along with returning trustee Bill Stern, and new candidates Carl Finger and Matthew Callaghan. Missing from the list was Thomas Martin, a current trustee, who served one term and was eligible for re-nomination.

I was very surprised to read the Scarsdale Inquirer's coverage of the purportedly confidential proceedings of the Scarsdale Citizen's Nominating Committee (CNC) in their January 30th edition. This week the CNC announced their slate of candidates for Mayor and Village Trustees, and like the Inquirer, Scarsdale10583 reported that former Village Trustee Jon Mark had been selected for Mayor along with returning trustee Bill Stern, and new candidates Carl Finger and Matthew Callaghan. Missing from the list was Thomas Martin, a current trustee, who served one term and was eligible for re-nomination.

Since the proceedings of the committee are confidential the public should not have known whether Martin decided not to apply for a second term or had put in his hat and been turned down by the committee. Since I served on both the Citizens Nominating Committee and the School Board Nominating Committee I knew that all conversations in the room were to remain confidential and that committee members were instructed not to discuss the proceedings with outsiders. This rule was put into place to protect nominees and encourage interested residents to apply.

When I didn't see Martin's name on the slate, I recognized the importance of maintaining his privacy. That's why I was really puzzled to read the article titled "Mark, Callaghan, Finger in for board; Martint out,"on the front of the Scarsdale Inquirer by reporter Jason Chevras. The article announced that Martin had not been re-nominated and then went on to quote the one-term trustee about how surprised he was to learn that he was not re-nominated after receiving a warm reception from the nominating committee. According to the article, Martin said that after his eight minute interview he was rewarded with "a round of applause and congratulated by two of the members for doing a "great job."

So much for confidentiality – not only did the paper publish confidential conversations – but the reporter forced Martin to be up front about his application for a second term. Had he not been asked, Martin could simply have said that one term was enough. Since Chevras is relatively new to Scarsdale and the newspaper perhaps he was not aware of the subtleties of the workings of the non-partisan system?

Then, in an editorial titled "Secrecy's dark side" the editor questioned the decision of the nominating committee, claiming that the CNC judged Thomas Martin on his resume prior to his first term as Village Trustee. She wrote, "But it appears that the committee – some of whose members were on the CNC when it nominated Martin in 2013 – went back to the original criteria, finding Martin's resume wanting." Now how did the editor know that? Is this conjecture, or did she speak to members of the CNC, knowing full well that their proceedings are supposed to be confidential? Ironically, the article goes on to state that "when a sitting trustee is rejected, confidentiality becomes a stigma that is out of keeping with the system's intent to honor all who desire to serve."

The editor also questioned the judgment of the committee, surmising that Martin was not asked to return because of he was not well known, because he held minority views or because the CNC members were ignorant. Part of the committees' selection procedure is to do due diligence and ask for feedback on the nominees from the community. This information, which is attributable to the source, is shared and reviewed by the committee. We can only assume that the 34 committee members did their jobs this year and asked for comments on all of the candidates. With this information in hand they evaluated the applicants and selected the four that they believed would best serve the Village. They assumed that their deliberations would be kept private to save Martin from facing public embarrassment.

In this case, it's not the actions of the committee that should be second-guessed or criticized; it's the newpaper's for failing to honor the system and maintain the confidentiality of the proceedings which are essential to the success of a non-partisan system. The Inquirer made its first misstep in asking Martin to comment on his failure to be re-nominated and compounded the error by publishing confidential conversations and by questioning the judgment of 34 elected members of the nominating committee. While we do have freedom of the press here -- this right should be balanced against community mores -- which dictate respect for the process and sensitivity to applicants' needs for privacy.

New Police Chief Installed and Five Officers Promoted at SPD Ceremony

- Details

- Written by: Hannah Wolloch

- Hits: 9797

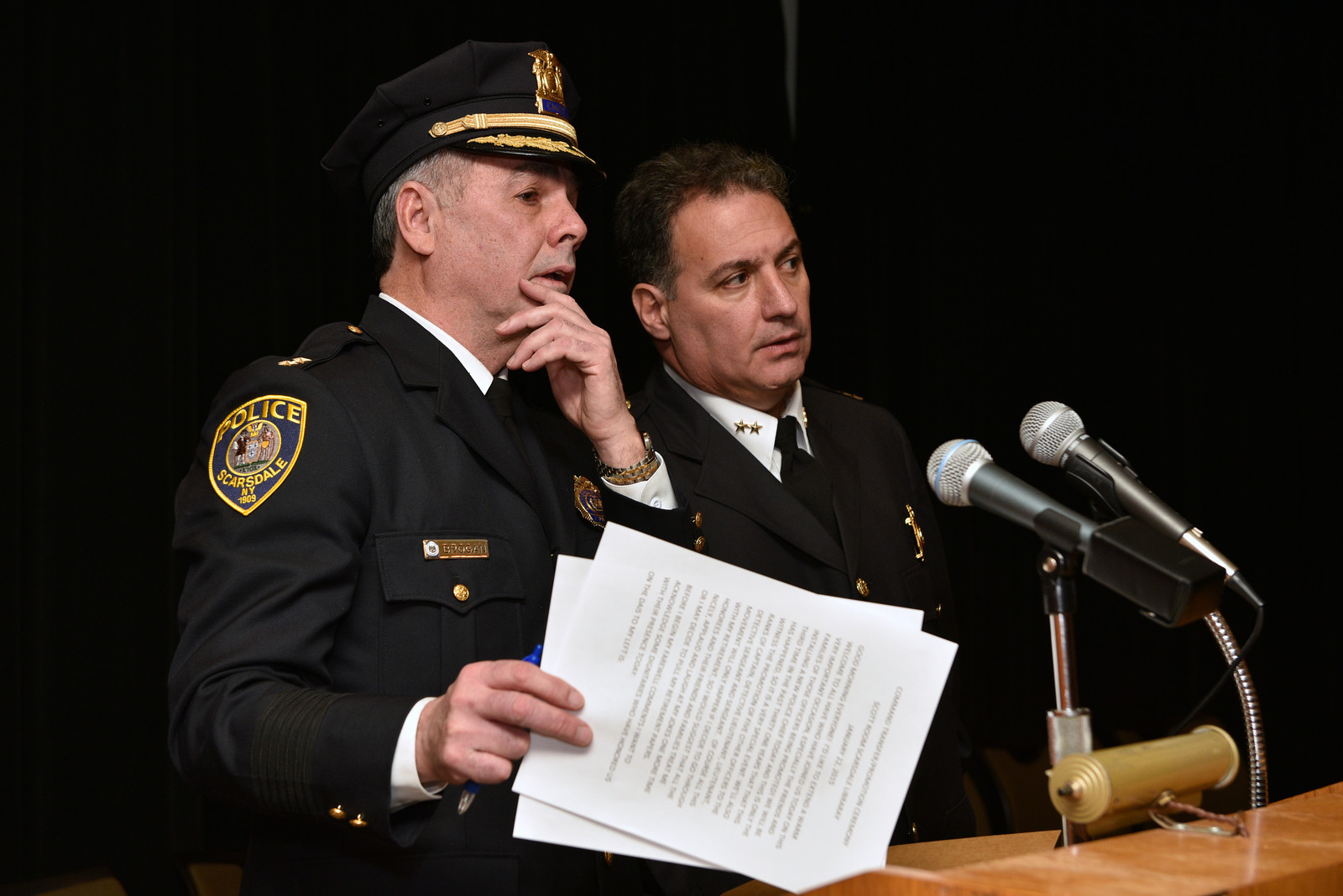

Scarsdale officially swore in new Police Chief Andrew Matturro at a ceremony at Scarsdale Library on January 22nd at 10:00 am and recognized outgoing Police Chief John Brogan for 37 years of service to the village. About 120 guests attended, and the room was filled with police officers, their families, village officials and staff who came to pay their respects to Brogan, Matturro and four officers who received promotions.

Scarsdale officially swore in new Police Chief Andrew Matturro at a ceremony at Scarsdale Library on January 22nd at 10:00 am and recognized outgoing Police Chief John Brogan for 37 years of service to the village. About 120 guests attended, and the room was filled with police officers, their families, village officials and staff who came to pay their respects to Brogan, Matturro and four officers who received promotions.

Police Chief John Brogan has dedicated 37 years of service to the community with 12 years as Chief of the department. He noted that Scarsdale has come a long way since February 5th, 1975, his first day on the job in town. At the time, domestic violence was considered a personal issue and driving while intoxicated was a nuisance. Oftentimes police would drive someone home or take their cars keys rather than place them under arrest.

Brogan said he had one goal when he entered the force; and that was "to leave it a little better than he found it." Throughout his tenure, his motto remained the same; he believes that the basic ingredient to good service is "a cop who cares", which Brogan certainly did. He remarked that a good cop "embraces the conscience of the town", and "has empathy", never forgetting that they should treat citizens the same way they'd want themselves and their families to be treated."

Brogan took the opportunity to thank many – including the trustees, Mayor Bob Steves, officials, the staff and Village Manager Al Gatta, for their guidance and cooperation over the years. He didn't forget to thank family and friends for their stellar support either, knowing that he couldn't have done it without any of them. He thanked his command staff for allowing him to have complete faith that they'd always give him the right answers, even when it wasn't what he wanted to hear. He expressed gratitude to all the men and women of the department for being "the manifestation of the motto SPD; service, pride, dedication."

Chief Brogan called incoming chief Andrew Matturro  a man of vision, confidence, character and compassion. These wise words Brogan had for his replacement came in the form of an Abraham Lincoln speech he quoted on the day of his own initiation. "If I were to try to read, much less answer, all the attacks made on me, this shop might as well be closed for any other business." He explained that this was the ideal he kept in mind when times got tough. To him the quote meant that though everyone has their own point of view on his work and choices, the most important thing is to work hard and do the right thing, regardless of people's complaints. Matturro will surely benefit from this advice in the years to come.

a man of vision, confidence, character and compassion. These wise words Brogan had for his replacement came in the form of an Abraham Lincoln speech he quoted on the day of his own initiation. "If I were to try to read, much less answer, all the attacks made on me, this shop might as well be closed for any other business." He explained that this was the ideal he kept in mind when times got tough. To him the quote meant that though everyone has their own point of view on his work and choices, the most important thing is to work hard and do the right thing, regardless of people's complaints. Matturro will surely benefit from this advice in the years to come.

Newly-installed Chief Matturro's initiation speech was equally as grateful and heartwarming. He started out by expressing gratitude to Mayor Steves, the entire Board of Trustees, Village Manager Alfred Gatta and Deputy Village Manager Steven Pappalardo for their confidence and trust in him to lead the department. He also thanked his wife and children for their support over the years. He gave credit to Scarsdale Village workers and officials of all kinds, noting that he would not be where he is today without the help of any of them.

He did have some concerns upon being named the new Chief--as many of us probably would! Soon after hearing the good news, he called former Scarsdale Police Chief Ferraro to thank him for the opportunity. He told him that he and Chief Brogan had left him with such an excellent and capable department, and wondered where he should go from here. Ferraro ensured him that there "is always room for improvement, and you can always move an organization forward", and reassured him that he would do a fine job.

The new Chief then went on to highlight the stellar job Brogan did as Chief in his 12 years. Echoing Brogan's goal to leave the department in a better state than he found it., he said,"Chief Brogan", Matturro said, "you achieved more than your goal." He noted that, though Brogan was dedicated and driven himself, he always looked out for others and pushed his officers to their limits. He thanked Brogan for his guidance, and explained that he will strive to be the kind of strong, yet caring leader, that Brogan was to this department.

The new Chief then went on to highlight the stellar job Brogan did as Chief in his 12 years. Echoing Brogan's goal to leave the department in a better state than he found it., he said,"Chief Brogan", Matturro said, "you achieved more than your goal." He noted that, though Brogan was dedicated and driven himself, he always looked out for others and pushed his officers to their limits. He thanked Brogan for his guidance, and explained that he will strive to be the kind of strong, yet caring leader, that Brogan was to this department.

Finally, Matturro had some wonderful words to share about the Scarsdale police officers. He explained that although many of them have impressive degrees that can be applied to many different fields and types of work, the one thing they have in common is that "each of them decided at some point that they would dedicate their professional lives to serving others." Though many of the officers do not live in Scarsdale, the passion and pride with which they fulfill their duties would make anyone believe they are residents. Noting that all eyes have been on the police (from Ferguson to New York City.) Matturro vowed that Scarsdale force would continue to serve justly and professionally—treating residents in the same manner they'd want their own families to be treated.

Matturro said that thought he is not usually one to brag about rank or achievements, he is extremely proud and honored to be named Chief of such an incredible department in an incredible community.

Also at the ceremony, five officers were promoted by the Scarsdale Police Department. Here is some information about each one:

Captain Thomas Altizio

Thomas Altizio joined the force in 1986, and has been  instrumental in organizing and maintaining the departments many Information and Technology systems. He has supervised many successful investigations and has done an exemplary job in advancing the efficiency of the Investigation Section. He has been promoted to the Rank of Captain.

instrumental in organizing and maintaining the departments many Information and Technology systems. He has supervised many successful investigations and has done an exemplary job in advancing the efficiency of the Investigation Section. He has been promoted to the Rank of Captain.

Detective Lieutenant Ed Murphy

Lt. Murphy began his career in 1990 with the Mount Vernon Police Department before joining the SPD. He served as a Field Training Officer, Patrol and Special Operations Sergeant and is currently the Commanding Officer of the Patrol Section--the largest one in the department. The Patrol section met 10 out of its 10 goals in 2014, which is a testament to Murphy's outstanding job and leadership. He has been promoted to Detective Lieutenant.

Lt. Murphy began his career in 1990 with the Mount Vernon Police Department before joining the SPD. He served as a Field Training Officer, Patrol and Special Operations Sergeant and is currently the Commanding Officer of the Patrol Section--the largest one in the department. The Patrol section met 10 out of its 10 goals in 2014, which is a testament to Murphy's outstanding job and leadership. He has been promoted to Detective Lieutenant.

Lieutenant Joseph DuSavage

Sgt. DuSavage entered the  force with the Putnam Valley Police Department in 1994 before joining the SPD. He is involved in many aspects of training, and has served as a Field Training Officer, Department Armorer, Head Firearms Instructor, Patrol Sergeant, and is currently the Special Operations Sergeant. He is being promoted to the Rank of Lieutenant.

force with the Putnam Valley Police Department in 1994 before joining the SPD. He is involved in many aspects of training, and has served as a Field Training Officer, Department Armorer, Head Firearms Instructor, Patrol Sergeant, and is currently the Special Operations Sergeant. He is being promoted to the Rank of Lieutenant.

Detective Sargeant James Newman

Sargeant Newman joined the Scarsdale force in 1997. He has been instrumental in the department's successful maintenance of its National and State Accreditation Programs and is involved in many aspects of training. He has served as a Field Training Officer and General Topics Instructor as well. He is currently assigned as the Accreditation/Training and Scheduling Sergeant. He was described by Matturro as a "jack of all trades", who always does what he is assigned without even a word in opposition. He is being promoted to Detective Sergeant.

Sargeant Newman joined the Scarsdale force in 1997. He has been instrumental in the department's successful maintenance of its National and State Accreditation Programs and is involved in many aspects of training. He has served as a Field Training Officer and General Topics Instructor as well. He is currently assigned as the Accreditation/Training and Scheduling Sergeant. He was described by Matturro as a "jack of all trades", who always does what he is assigned without even a word in opposition. He is being promoted to Detective Sergeant.

Sargeant David Rosa

Rosa joined the Scarsdale Police Department  in 2006 after serving with the New York City Police Department for 6 years. He is a certified bicycle officer, Field Training Officer, and is currently working in the Patrol Section. David is known as a knowledgeable senior police officer who is always willing to assist new officers as they learn and acclimate to their new positions. He is being promoted to Rank of Sergeant.

in 2006 after serving with the New York City Police Department for 6 years. He is a certified bicycle officer, Field Training Officer, and is currently working in the Patrol Section. David is known as a knowledgeable senior police officer who is always willing to assist new officers as they learn and acclimate to their new positions. He is being promoted to Rank of Sergeant.

Photos by Jon Thaler - see more and purchase copies here.

Village Manager Al Gatta to Retire After 20 Years in Scarsdale

- Details

- Written by: Joanne Wallenstein

- Hits: 10796

Scarsdale Village Manager Al Gatta has announced that he plans to retire this coming June. Gatta has run the Village for as long as most can remember, managing many major infrastructure improvements and a professional staff who some say are among the best in the county. We spoke to Gatta about his time in Scarsdale and why he plans to step down this year. Here is what he shared:

Scarsdale Village Manager Al Gatta has announced that he plans to retire this coming June. Gatta has run the Village for as long as most can remember, managing many major infrastructure improvements and a professional staff who some say are among the best in the county. We spoke to Gatta about his time in Scarsdale and why he plans to step down this year. Here is what he shared:

How long have you worked in Scarsdale and where did you work before?

I have been in Scarsdale for twenty years and before that I was City Manager in Hartford, CT; Ann Arbor, MI and Methuen, MA and held management jobs in New Jersey.

What do you plan to do when you retire?

I am looking to do more policy work which means housing, employment, regional approaches to services, funding schools, income maintenance, transportation and how best to fund local governments. I may also teach a class or two which I did at Trinity College in Hartford and University of Michigan in Ann Arbor.

Why did you decide to retire now?

It is time to move on. Any good organization has to have movement at the top to bring in new perspectives and approaches to addressing challenges. We have done a lot of employee training and education and have made the organization one of the better ones in the County;

What are you proud of?

Twenty years is a good run and I was the first educated and trained professional manager in Scarsdale and brought management improvements to the finance system, budgeting, decision-making process and line services. Former managers followed the old pattern of either being a trained engineer or attorney to serve as managers.

I managed many capital projects over the years such as downtown traffic, parking, pedestrian improvements, sidewalks; the Christie Place Development and parking facility; the new Popham Road Bridge; the new Public Safety Building; pool improvements; new athletic fields including one artificial turf field at the High School; Kids Base program and long term lease; restrooms and tennis building at the high school and new restrooms and a tennis building at Brite Avenue. We closed the compost facility at Crossway and built the leaf transfer station at the same location, renovated the Supply Field Building, completed major multi-million stormwater projects and renovated all 16 village playgrounds. What else? We did a rehab of the Scarsdale Railroad Station; a land lease with SVAC; multimillion renovations to the Ardsley Road and Reeves Newsome Water Pumping Stations, initiated the rehabilitation of the Fire Station #1 and the rehabilitation of Wayside Cottage.

What were some of the biggest challenges you faced?

The challenges all involved being part of and managing a non-political system that made decisions by trying to achieve consensus. It takes patience, understanding, tolerance and faith. There were no shortcuts or decisions made easy because of the political votes. It's a very good structure for local governments.

What were some of the most controversial issues during your tenure here?

Controversial issues are always budget, taxes and particular land use issues as illustrated by the constant tension between the need to change and the limited growth theory. Also the interference of the State government in the management of local affairs, particularly budgeting and taxation by ranking bureaucrats who have no local government experience but do have great political acumen.

Who were some of the more "colorful" residents you encountered?

There have been a few and I have always taken it in stride. Looking for the humor in most instances is the only way I have survived for 45 years.

Who did you enjoy working with?

I have been fortunate in having had the best elected officials anyone can hope to work with as a local government manager. The elected officials have been smart, educated, sensitive, caring, wanting to do the right thing for the community honest, and nonpolitical. Also the Village employees and Department Heads have been among the most trained and educated I have worked with over the decades and compared to other local government workers in the county are head and shoulders over their performance.

What will be your legacy to Scarsdale?

I am not interested in a legacy; after all I am not the president of the United States and one thing I am very proud of is that I never took myself and position too seriously. The quality of work and honesty and straight talk was always a desire of my wanting to do my job as well as possible. I never tried too "out slick" anyone and those that did it to me drew my disdain.

In an email to Village staff announcing his retirement, Gatta said, It has been a pleasure towork with all of you during the last two decades as there is no way any manager can be successful without a loyal hard working workforce."

Veterans' Tax Exemption Revisited By Scarsdale BOE

- Details

- Written by: Melissa Hellman

- Hits: 4872

The issue of the Alternative Veterans' Tax Exemption was revisited at the Board of Education (BOE) business meeting on January 12, 2015.

The issue of the Alternative Veterans' Tax Exemption was revisited at the Board of Education (BOE) business meeting on January 12, 2015.

To recap, Governor Cuomo enacted legislation in December 2013 that would allow (but not require) school districts to provide tax relief to qualified veterans. Veterans already receive partial exemptions for Village and County taxes, and this new legislation provides an additional avenue for exemptions. The law provides a benefit for qualifying veterans and their surviving spouses by reducing their taxable assessments – and therefore their property taxes. As of April 2014, there were 305 veterans in Scarsdale receiving various levels of exemptions.

In April 2014 the BOE discussed this issue at a business meeting. Ultimately, the Board voted against the exemption by 5-1 based on the fact that information about the implications to the other taxpayers were unclear partially because Scarsdale was in the midst of a property valuation reassessment. The burden of the exempted amount (at the time estimated to be $558,358 at the highest level of exemption) would not be funded through the state or federal government but would be shared among the balance of Scarsdale taxpayers. The legislation required the resolution to adopt the exemption to be passed by May 1, 2014 (along with a required public hearing) so there was little time to gather additional financial information or hear from the general public on the issue. Many veterans spoke at that meeting and were extremely disappointed that the BOE voted to take no action on the matter.

Fast forward to January 2015 when the BOE feels more confident about the timing and its ability to gather information. The Board was in agreement last night that it should move forward with the first step of providing the basic exemption level for qualified veterans. Once a resolution that a basic level of tax exemption is enacted, the Board may decide to increase or decrease the exemption level based on specific guidelines set forth in the legislation. The decision to increase or decrease the exemption amount is required to be made under a separate resolution and after a public hearing. The plan right now is that a resolution on the basic exemption will be available for discussion at the next BOE meeting on January 26, 2015 and will be voted on at the February 9, 2015 meeting along with the required public hearing. The Board has asked for more information from the Scarsdale Tax Assessor to be available for the January 26 meeting in order to fully understand the numbers involved.

During the public comment period, the BOE heard from two long-term resident veterans. Mr. Martin Molot of Lincoln Road wanted to make sure that as the BOE weighed the additional tax burden to non-veterans it took into account the fact that the overall tax base in Scarsdale is increasing as a result of the large amount of new construction.

Mr. Newton Schiller of Lee Road said he attended the meeting to make sure that the BOE took action on this item and thanked the Board for making decision to move forward.

Community members are urged to view this portion of the meeting on the BOE video on demand site as well as to review the supporting materials available with the January 12, 2015 meeting agenda and come to the next BOE meeting with questions and comments.